The Power of Emergency Savings

In today's unpredictable world, having a robust emergency savings fund has never been more critical. A sudden job loss, unexpected medical expenses, or an unforeseen home repair can throw any well-laid financial plans into disarray. That's where the importance of a high interest savings account comes into play. In this blog post, we'll explore the benefits of storing your emergency fund within a high interest savings account, where it can grow at a steady pace while providing you with peace of mind.

1. Safety and Security:

When it comes to safeguarding your emergency funds, it's essential to prioritize safety. High interest savings accounts (HISA) are typically provided by reputable financial institutions that are heavily regulated, offering you the peace of mind that your funds are secure. These accounts are often insured by government-backed programs, providing additional layers of protection against potential losses. With this solid backing, you can rest assured that your emergency fund is in safe hands.

2. Competitive Interest Rates:

A key advantage of high interest savings accounts is their ability to earn interest at rates far superior to traditional savings accounts that sit around. While the interest rates in other accounts might be negligible sitting at around .2%, high interest savings accounts offer a substantial return on your money. With current rates ranging between 4% and 4.5%, your emergency fund has the potential to grow considerably over time, enhancing your financial stability. During 2020-2022 most HISA sat at 0%, this is because the interest rates follow the Federal Bank.

3. Liquidity and Accessibility:

In emergency situations, swift access to funds is crucial. High interest savings accounts strike the right balance by providing both liquidity and accessibility. Unlike other financial instruments where your money may be locked up for extended periods, high interest savings accounts allow you to withdraw your funds when needed, offering greater financial flexibility during turbulent times.

4. Compound Interest Effect:

When it comes to growing your emergency savings, compounding is a powerful ally. High interest savings accounts compound interest either daily, monthly, or annually, allowing your money to grow at an accelerated rate. As interest is continuously reinvested and added to your principal balance, the compounding effect amplifies the overall growth of your savings over time. This compounding phenomenon can make a significant impact on your emergency fund, helping it to grow even faster. $15,000 at 4% for one year is $623.

5. Navigating Interest Rate Fluctuations:

While high interest savings accounts typically offer competitive rates, it's essential to acknowledge that interest rates can fluctuate in response to economic conditions. The advantage of a high interest savings account lies in its ability to provide a higher baseline interest rate compared to traditional savings accounts. However, it's important to stay informed about any potential rate changes and adjust your emergency fund strategy accordingly.

When interest rates rise, the return on your emergency savings fund can increase, providing an opportunity for even greater growth. On the other hand, when rates decline, it's crucial to monitor the overall interest rate landscape and be prepared for potentially lower returns. Staying proactive and informed will allow you to make necessary adjustments, such as exploring alternative high interest savings accounts or gradually reallocating some funds if more favorable options become available.

Remember, the objective of an emergency savings fund isn't solely dependent on interest rates but rather its primary purpose of providing financial stability during unforeseen circumstances. However, it's prudent to consider interest rate fluctuations as a factor that could affect the growth and yield of your emergency fund. Stay vigilant and periodically reassess your options to ensure you're optimizing your emergency savings strategy.

5. Building a Strong Financial Foundation:

An emergency savings fund acts as a safety net, providing you with a solid foundation to weather unexpected financial storms. By utilizing a high interest savings account, you not only protect your funds but also give them the potential to grow. This empowers you to tackle emergencies without resorting to debt or depleting your other financial resources. Strengthening your financial position and having the ability to face uncertain times head-on gives you peace of mind, ensuring a more secure future.

Conclusion:

The importance of having an emergency savings fund can never be overstated. By opting for a high interest savings account, you'll maximize the growth of your funds while ensuring their safety and accessibility. With competitive interest rates and the power of compounding, your emergency fund will have the potential to flourish and provide you with the security you need. Embrace the benefits of high interest savings accounts and take control of your financial well-being, empowering yourself to overcome any financial curveballs that may come your way.

Robo Advisor, DIY Investing, or Financial Advisor?

Making investment decisions can be daunting, but there are various strategies available to help you grow your wealth. In this blog post, we will explore three popular approaches to investing: Robo Advisor, DIY Investing, and Financial Advisor. Each option offers unique benefits and considerations, allowing you to make an informed choice that suits your financial goals and preferences.

Robo Advisor: Efficiency meets Expertise!

Robo advisors have revolutionized the investment landscape by leveraging advanced algorithms to automate portfolio management. Here are some key advantages and potential drawbacks of utilizing a robo advisor:

Pros:

1. Automated investing for busy individuals: Robo advisors allow you to relax as they handle your portfolios, saving you time and effort.

2. Diversification like a pro: These platforms spread investments across various asset classes, aiming to minimize risk while optimizing portfolio growth.

Cons:

1. Limited customization options: Robo advisors may not accommodate unique investment strategies, as their focus is on ease and efficiency.

2. Lack of human touch: If you prefer personal interactions and tailored advice, robo advisors may not fulfill your need for human empathy and understanding.

DIY Investing: Unleash Your Inner Financial Warrior!

DIY investing empowers you to take control of your investment decisions and manage your own portfolio. Here are some considerations when venturing into the world of DIY investing:

Pros:

1. Tailored to your goals: You have the flexibility to customize your investment decisions, aligning them with your specific financial objectives.

2. Seizing opportunities: DIY investing allows you to respond quickly to market changes and take advantage of exciting investment prospects.

Cons:

1. Learning curve: DIY investing requires a deep understanding of financial markets, trends, and risk management strategies, which may pose challenges for beginners.

2. Emotional biases: Investing alone increases the risk of being influenced by market hype or fear, potentially hindering your long-term wealth creation plans.

Financial Advisor: Experience You Can Rely On!

Enlisting the services of a financial advisor provides you with professional guidance and expertise. Here are some factors to consider when working with a financial advisor:

Pros:

1. Personalized advice: A financial advisor will create a customized investment strategy based on your goals and risk tolerance, tailoring it to suit your unique needs.

2. Stress reduction: By managing your portfolios, financial advisors allow you to focus on other aspects of your life while capitalizing on their expertise.

Cons:

1. Cost considerations: Financial advisors usually charge fees for their services, which can impact your investment returns. It is essential to assess and compare these costs.

2. Trust and compatibility: Choosing the right financial advisor requires diligent research to find someone you trust and who understands your aspirations.

Conclusion:

When it comes to choosing an investment strategy, it's crucial to consider your goals, risk tolerance, and personal preferences. Robo advisors offer convenience and diversification, DIY investing provides flexibility, and financial advisors bring professional guidance to the table. Assess your needs, weigh the pros and cons, and make an informed decision to unleash your wealth creation potential!

Which investment path resonates with you the most? Are you attracted to the efficiency and expertise of robo advising, the flexibility and control of DIY investing, or the reassurance and guidance of a financial advisor? Share your thoughts and embark on a conversation about the best approach to grow wealth!

Starting Over and Unsure Where to Start? Try here first.

Finances aside, everybody's starting over is going to be different, but I do think there are a few common denominators in every divorce, or even break up for that matter. And, often times when we are feeling stressed and overwhelmed it's a key indication we need to slow down, get quiet, and listen to our inner voice. Now is the time to cultivate a relationship with yourself, this could be the start of quite the journey of self discovery - if you let it.

"Use your pain as rocket fuel to your next level of self."- Mark Groves <~ he seriously is da’ 💣

Feel your feelings, like actually feel them. All the pain, grief, anger, shame.... all of it! Emotions are energy in motion, they are meant to be felt and moved through. If you push it away, deny the feeling or try to distract yourself (with shopping, sex, booze, staying busy) that feeling is going to persist only to get bigger and bigger and be more of a challenge to work through at a later date. Create a safe space to feel this, perhaps you crawl under a cozy blanket, light a candle, play soft music and let it happen, let it flow. You will be ok, remember the more you feel it, the more you heal it. If you are needing some tips on the somatics of emotions - please message me as this was part of training becoming a Coach.

Take the time to be alone. Do not get into another relationship to mask the pain you are feeling. This will not end the grief, it will only put it on hold and you will end up hurting people that you get involved with, or you’ll end up in another recycled toxic relational pattern. Resist the temptation and remain grounded in your healing journey so you can then build relationships from love and abundance, not fear and lack. Remember everything is energy. We want to create from the inside out.

Create your emotional support team. Whoever this may consist of, a family member, a good friend, a trusted confidante, a therapist. Build it, and build it well. Some suggestions;

You need a hype person to build you up when you feel like shit.

An empathetic, compassionate person to listen when things are heavy.

You need a person who inspires you to keep moving towards your dream.

You need a therapist to clean up your side of the street.

It’s helpful to lean on someone who has also been through what you’re currently going through.

It's helpful to tap into all resources you can, books, online resources, coach's, and support groups that share similar values as you.

Ask for help, yikes! lol, yes, I said it! And, I also understand that this can be the hardest thing to do especially for women who have conditioned themselves to be the strong one, the one who doesn't need help, the go getters, corporate leaders and do it yourselfers. But, you are not immune to this pain, when you notice yourself getting lost in depression, resentment or anxiety asking for help can save you from going down a negative path that you may have a hard time coming back from. I’ll share more on my journey there at a later date when I’m ready to.

And, my favourite one, connect with your passions and take care of yourself. Give yourself the gift of nourishing food, walks in nature, long bubble baths (dudes too if you’re still with me 😉 take a toy boat in the bath with you 😂 — if you didn’t get that reference we can’t be friends) anything that makes you feel cared for. Reconnect to your passions and hobbies, maybe you’d like to take a photography class, or join a rec sports team, add these into your life and start filling yourself up, this is the fun part (and sometimes hard part) about being single, you get to date yourself and it really is rewarding!! You might have to take small steps to get out of your comfort zone and **gasp** dine alone, so start small with a morning coffee with a book? Or, a drink on a patio solo. You have to teach yourself how to do it by practicing it and that’s the hardest part! You have to practice and INTENTIONALLY DO IT! Mel Robbins says 5-4-3-2-1, and get up and do it before your brain has a chance to argue.

Remember to honour yourself, and what you've been through. This journey is transforming you, let it. You are tearing down a old house and rebuilding a new one, built on a stronger foundation. Explore yourself and what you want your life to encompass, discover who you are at a soul level, start establishing new values, more powerful beliefs, newer more vibrant dreams.

If you have resonated with this post and have been looking for support getting to the next version of you take this as a sign to reach out and we can chat about how I can best assist you in reaching your goals. Book a call under the contact section.

Survey Says!

In an open survey directed towards women I asked the question: If you were given the opportunity to contribute advice and/or words of encouragement to a women’s empowerment guide after divorce what would it be, and the responses were powerful and inspiring.

Divorce can leave us feeling lost, confused, and overwhelmed. That’s why I want to create a space here or women to share their experiences and insights to help those who are now going through the same struggle. Here I will share some responses and hope these words will find you when you need them the most;

Don’t be too hard on yourself as you heal and figure it out. Spend time outside your comfort zone, and under the covers. Learn to know what you need in the moment.

How to find your “yes’ and no’s”

Your kids will be ok —> I teared up on this one, this is one thing I still struggle with is the guilt

Make sure your insurance is in order and don’t wait to get things done —> reach out if you need support here.

Be selfish and wise with your money. Think of your future not giving it all to your kids

You will make it through, I know it seems like there is no end in sight, struggling to find the light but when you keep going and don’t give up the light will eventually come. Find your supports, find a therapist and be kind to yourself. Take time off if you need, there’s no shame to put yourself first here

Know your non negotiables with yourself and others

Budget, income, how to transfer assets and how to have a good relationship with your ex

If possible, know what you want and your spouse wants from the divorce and come to an agreement outside the law office! In my experience, once lawyers were involved I was f*cked, not saying this would happen for you, but 30k in lawyer debt was my story, and there is so much regret and trauma about this process. #1 - utilize divorce mediation services or collaborative law if viable #2 work with a divorce coach to get to the agreement prior to lawyers office #3 use CFDA (Certified Divorce Financial Analyst) specifically trained in divorce

I offer many different programs and coaching packages to help you through this stage that can be tailored to your specific needs. Along with my professional designations and experience I also have the personal experience of divorce with two young children at the time. Book a call under the “contact” page and let’s tackle this together!

Sunk-Cost Fallacy

The sunk cost fallacy is a cognitive bias that occurs when people make decisions based on the amount of time, money, or effort they have already invested in a project or decision, rather than on the expected outcome or future costs and benefits. This could be bias leads people to continue investing in a project or course of action, even when it is no longer rational or beneficial, because they feel they have already invested too much to give up. This can result in poor decision-making and can prevent people from changing course or cutting their losses when it would be more advantageous to do so.

Here are a few examples of the sunk cost fallacy in finance:

1. Holding onto a losing investment: An investor may hold onto a stock that has been losing value for a long time, even when it becomes clear that the stock is unlikely to recover. This is because the investor has already invested a significant amount of money in the stock and does not want to take a loss.

2. Continuing to pay a high fee for a financial advisor: A person may continue to pay a high fee for a financial advisor even if the advisor is not providing any value, simply because they have already paid a lot of money for their services.

3. Investing more money in a failing business: A business owner may continue to invest more money in a failing business, even when it becomes clear that the business is not profitable. This is because they have already invested a significant amount of money and time in the business and do not want to give up.

4. Completing a project that is no longer necessary: A company may continue to invest time and money in a project even after it becomes clear that the project is no longer necessary or valuable. This is because they have already invested a significant amount of resources in the project and do not want to abandon it.

When making a decision whether to change or keep doing things the same. Don’t get stuck in “I’ve already put so much I to this, I just have to keep doing it.”

Here are some ways to beat sunk cost fallacy:

1. Recognize and acknowledge sunk costs: The first step in overcoming sunk cost fallacy is to recognize and acknowledge that the costs that have already been incurred are sunk and cannot be recovered. Accepting that the past cannot be changed helps you to make decisions based on the current situation and future prospects.

2. Reassess the decision: Ask yourself if the decision you are making is based on the current information or your past investment. If the current situation does not warrant the investment, you should consider abandoning the project and moving on.

3. Evaluate the value of the investment: Evaluate the value of the investment objectively and see if it aligns with your goals. Consider the opportunity cost of the investment and whether the resources could be better used elsewhere.

4. Seek advice: Seek advice from a neutral third party, such as a financial advisor or a mentor, to help you make an objective decision. A fresh perspective can help you see the situation in a new light.

5. Practice mental accounting: Practice separating the money that has already been spent on a project from future decisions. This way, you can make decisions based on the future value of the investment rather than past investments.

Remember, sunk cost fallacy is a common cognitive bias, and it takes time and practice to overcome it. By recognizing and acknowledging sunk costs, evaluating the value of the investment, and seeking advice, you can make better decisions and avoid throwing good money after bad.

Transforming Your Life

I was separated at 29, divorced by 32 after a long court battle that only caused severe hurt, pain, trauma and anger.

At 35, I was tired of living the life I had been living, struggling, pushing through, approaching each day the same and just doing the things that I had to do in order to survive, playing the same script. I was tired, depressed, lacked support and didn't know what to do.

I am a spiritual being, a mystic, empath and intuitive. I pray, I meditate. I pulled an Oracle Card one night during prayer asking for guidance and the card I pulled was "Inspiration" and the message included one of being acutely aware of the signs my guides were sending me as there was things I was missing. One important guiding factor was to watch for signs of a bumblebee, whether it was pictures I come across, items in stores, or even someone dressed in a bumblebee costume!

As the days proceeded, I was following a Coach who had some really valuable content that I enjoyed watching, never really thought of hiring a personal coach, then she started posting bumble bees! Everywhere! In her stories, on her posts, she was a bumble connector bee! She was following her passion and her light when she attracted me, and she was just what I needed to shift my life.

I didn’t know that Life Coach’s were a thing at that time, sure there are sport coach’s, fitness coach’s, tutor’s etc, but a life coach!? The wildest thing, and she’s the reason I became a Certified Coach myself. I joined her 3.5 month group program where myself and seven other individuals worked to become our best selves. These seven people including my coach were my lifeline and support building a healthier more aligned life. I learned about my inner child, my limiting beliefs (no idea this was a thing!), the stories I chose to live in and that I have a choice to change my narrative. I didn’t need to be stuck in victim. I learned how to feel feelings I had internalized and how to express them in a healthy way, (still learn everyday!) I learned what dreaming feels like, what becoming my best friend feels like, a concept lost throughout my years. I started recognizing when I was stomping out my own fire and getting in my own way with my own fears, insecurities and stories!

I learned how to believe in myself - I never did before, I treated myself poorly because the message I received was I never enough, I didn’t know there was a different way. I reinforced that belief by putting myself in situations (unconsciously) where people would hurt me (because that felt normal), I created a pattern of doubt, of not being good enough, and feeling powerless and hurt. It was the only thing I knew how to do, and I kept getting stuck in a loop of self defeating thoughts, depression and anxiety not knowing I was doing it to myself.

I think all humans feel this on some level, it’s not until we become aware of what we are actually doing that we then have the power and choice to change it. This takes commitment, emotional intelligence, and self awareness. This is why I do the work I do supporting Women through big life transitions, I know what it is like to feel lost, alone and afraid. I gift you my knowledge that has taken me years to accumulate, so you don’t have to struggle and wonder for as long as I did. I have the keys and I want every woman in my line of sight to claim their life back, unapologetically!

Naturally, my 20 year career in finance, enables me to empower you to take control of your finances, which is a big deal while in the throws of transition and creating a new life! My coaching expertise then supports your new path, enhancing your money mindset, worth, and getting you unstuck!

How is this all connected you might ask? You will only accept what you think and feel you deserve. If you feel like shit, disrespect your body, lack boundaries, confidence and self awareness you will stay stuck in a unfulfilled life, no doubt about it. You will accept the unhappy and unfulfilling career, you will continue to experience toxic relationship and friendships like an old dirty shirt continuing to ask yourself why, you will seek coping mechanisms with terrible money and life habits. You will slowly rot and never know what you need or live your full potential, because this is the only way you’ve ever lived and the only way you know how!

When you treat yourself with love by eating healthy food, working on your esteem, beliefs, goals and habits, while growing your emotional intelligence, you are sending a very definite signal to the universe you are not f***ing around and demand better! You learn your boundaries and how to communicate them, you do not allow people to take advantage of you or allow misaligned people into your life. No more excuses for their shitty behaviour or your behaviour that used to accept it! Instead, you will rise up attracting strong healthy people who are supportive, inspiring, growth orientated, and encourage you to see the positive. You start accepting what you truly want in your life, which means inner richness, fulfilment and overall life alignment!

My desire is to build relationships and educate women who are on their healing journey and understand that monetary wealth is only a piece of our wholeness, (a very important piece!) I empower you and show you how to make smart financial decisions all while becoming your best self.

By getting curious about your money story, limiting beliefs, and false narratives you build a foundation of strength, resilience, empowerment and love that provides you the courage and confidence you need to live out the big dreams you have!

Do you need some extra support? Please book in a “Let’s Connect” chat. Go to my contact page and scroll to the bottom where it says “Book with Kimberly.”

Big Announcement

Welcome back to my blog! I trust you all had a amazing Summer filled with all of the moments you love!

As promised, it’s Fall of 2022 and I’m ready for THE BIG ANNOUNCEMENT!

I made a big bold move this Summer, which lead to me grieving an identity I had for half my life! I celebrated (and grieved) spending more time with my girls, going back home to see family, taking in a few concerts and festivals, spending time on the water, in the mountains and of course lots of self care and love as I transitioned my life.

I resigned from my career as a corporate employee in Wealth and Investment Advisory. This was a huge move that has been months, even years in the making. After 19.5 years I am honoured to of worked for a great company meeting so many great people who have become friends, and taking with me a plethora of knowledge, skills and determination.

Many of us know that our greatness is on the other side of fear. We know, in order to realize our dream we must make big bold inspired and strategic moves. I did just that and decided to pursue my business full time, my dream and vision to build a financial practice specializing with women in the midst of big life transitions.

My practice is built on the foundation of cultivating deeper relationships, empowerment and trust with my clients, backed by integrity and solutions that make sense. Wealth Inside Out serves women by adopting a holistic relationship based approach providing education, workshops, financial advisory and coaching empowering women to take control of their financial future so they can step into a new chapter inspired, and motivated creating a robust financial future for themselves.

This means I can support you with;

✅ Budget/Cash Flow Analysis and Accountability

✅ Debt management/Repayment Structure

✅ Investments Planning/Advice/Education

✅ Financial Literacy Skills and Independence

✅ Insurance Protection and Living Benefit

✅ Women’s Life Transitions

✅ Educate and empower financial independence

✅ Managing Divorce and Widowhood -> 2 incomes to 1 and emotional impact

✅ Identifying and breaking patterns getting in the way of your success

I help you get clear on your goals and develop a mindset essential to lasting abundance, fulfilment and happiness. Every relationship is unique in its own way and treated as such with packages tailored to individual needs, dreams and desires.

This is how I was meant to do business. I’m community, connection and compassion.

I’m so glad you’re here with me! If you need support, please reach out via contact page, and follow along on my IG and FB as I provide helpful content.

Kimberly Dawn

Summer Holidays!

Thanks for being here and supporting my mission! We are on Summer holidays, Wealth Inside Out Blog will be back September 1st. For the Summer I am enjoying my two girls, building the business on the back end and taking in as much sunshine as possible.

We have exciting announcements in Fall of 2022!

I hope you enjoy your Summer and find joy in your day.

Kimberly Dawn

You Are Enough

I do things differently. I'm not in a box, and I'm not for everyone. I like to talk about behaviours, psychology, emotions, trauma, spirituality and how our beliefs are built, along with teaching my skill set when it comes to finances. I tend to talk about things that are considered "taboo" and most may shy away from on a public platform. I like the idea of putting all this together and pushing the limits and the narratives we live by.

Our financial world needs a change, one that is more open, accepting and compassionate of one's situation. One that educates instead of sells, one that puts client relationship, trust and integrity at the top. We need more compassionate, judgement free zones where we have permission to take off our masks we hide behind.

I support women; single working moms, corporate mom's, divorcee's, widows and provide financial empowerment education. As a Single Divorced Working Mother (and yes, that deserves a title with all the capitals!) I know you well. I know the challenges of being a single mom, I know the emotional and financial toll divorce takes, I know the shame and guilt that comes with being a single mom, while navagating the pressure of wanting to provide the life we always dreamed of for children. These emotions run deep, and in finance we need to be going deeper. We need to be changing how we look, feel and manage money in order to make any lasting change.

Did you know that we all have a unique money story, just as we each have our own unique personal journey?

The way we were raised, the narrative we were taught, the discussions or arguments witnessed in childhood all carry forward to adulthood in ways you may not even be aware of.

In my discussions with many single working moms, their biggest worry was not giving or providing enough for her children. One Mom in particular was the amount of downsizing she had to do after her divorce.

She went from a large grand home, to a 2 bedroom apartment with 2 kids and she held so much guilt and shame for this, she continued to beat up on herself as she didn't feel like she was enough of a mom because of this, and if she could just get back what she had, it would be different.

This story also hits close to home, it was interesting as she spoke these words, she was describing my life 10 years ago freshly out of a marriage, walking away from everything I had owned including my house and into a 2 bedroom condo with 2 children on the "bad side of town". I felt her words deeply, knowing exactly the shame, sadness and pain she was feeling. As I probed her for the root of the pain, I asked what her childhood conditions were like, there, in that moment the lightbulb turned on. "Oh my goodness, we lived in low income housing," she said. "I was always so embarrassed, I always told myself that I would do better with my life. I never wanted people to see where I lived, I would be asked to be dropped off blocks away from my house."

These experiences shape who we are. Much like her as a kid I was raised by a single mom who worked three jobs, I told myself at a young age I would never let my kids know what never having enough felt like. And, in my darkest days, during my divorce while navigating being a single Mom, I shared the same feelings she was experiencing. When my 5 year old definition, my reality, my feeling of "didn't have enough" was now true.

But, what if at that time I knew more, what if I knew to question my beliefs? What if I knew this was a belief I currated from when I was a little girl experiencing lack, and it no longer has to be true? Can we challenge that thought and do the work to install a new belief?

This is why I’m here, to teach and bring awareness. AND, this is where YOUR work is if you find yourself resonating!

If you don't start to ask questions around why you operate and think the way you do, you will forever be living in your conditioned state of being. Our emotions run our money, our money story can get in the way of true wealth and happiness. Financial management and wealth creation are a piece of the puzzle. In order to live a truly fulfilled WEALTHY life we need to dig deeper into our stories, and investigate with no longer holds value, and then, how can we transform it into something that does provide value?

What’s Your Definition of Wealth?

I can't believe it, next January I'll be able to say I’ve been in the finance industry for 2 decades!! Woah 😳 that's a long time, and it makes me feel super old! I did start as a baby though, so lets keep that in mind ;)

Over these years I've gained substantial knowledge in financial management, and, these things have always remained; My integrity and dedication to clients and the relationships we build together are #1, fuelled with my passion for investment planning and providing financial education so my clients feel empowered and in control of their financial life, so they can feel free, and live the life they love!

What does wealth mean to you?

I’ll share mine as money is only a piece of the wealth pie, it plays a large role in my life and is used as a tool to help me (and help my girls) reach our goals, but true wealth isn't only monetary in my mind. It's feeling fulfilled from the inside out, it’s overall happiness and contentment in life, and enjoying more of the small moments we can easily take for granted. Its feeling grateful for our life and taking an extra beat in a fleeting moment. Its catching those moments being so in alignment with who we are that our heart and soul radiates energy that is magnetic and attracts all the synchronies and blessings into our life. It’s living outside our comfort zone and riding the edges of our heart so we can continue to expand into who we are. Wealthy is feeling fulfilled from the inside out.

Has your self worth been tied to your career, and security to money?

A question not typically asked or understood due to the vulnerability of it.

I wouldn't of questioned it until I started digging deep and realizing some of mine was...

Here’s some things I learned about wealth, and my career status when I decided to take a step away from my professional titles and being a “successful corporate woman”;

I’ve been in Finance for 19 years. I grew up in the corporate world and I very much adopted the mentality of excelling, performance, pushing myself and exceeding. I created this linear illusion of success that validated my power and worth. As long as I was climbing the corporate ladder and excelling I felt worthy. As long as I had money in my bank and investments with some zero’s behind it I felt like I was somebody. As long as I had initials behind my name representing different financial designations, and as long as I had a position of power I was strong and confident.

I tied a lot of my worth and who I was to my career, it became my identity. The money in my accounts was a form of security for me, albeit false, because no matter how much I had I never felt secure and was always operating in lack. I inadvertently built my worth and my security outside of myself, and it was conditional on how much I achieved.

It took intentional healing and slowing down to confront this truth. It wasn’t pretty, I chose to deconstruct who I built myself to be. I let go of titles and who others thought I was, along with beliefs and behaviours that were no longer serving me. This is part of being human and living a life in alignment. When we start to ask the hard questions, we begin to heal and we start to demand better for our life. We stop making excuses, and begin to cultivate our own inner richness and power, building a life from the inside out, not outside in. We no longer try to fit in someone else’s definition of who they think we are and give ourselves permission to let go, and evolve into our next version of self.

“Measuring wealth by money alone is spiritually empty. To obtain wealth of lasting kind, the kind that gives your life value, meaning and sustenance, base your daily existence on your spirit and seek more out of life.” ~ Deepak Chopra, MD

Do you want to feel more empowered and knowledgeable with your finances, as well as learn to live an abundant life aligned to your inner richness and not reliant on your bank account? Have you resonated with my words?

Contact me to find out what that could look like for you.

We all need teammates, and I’d like to be yours.

Don’t walk, RUN! The market is on sale!

The S&P 500 has lost 15% of its value since the beginning of this year.

Market crash/correction sounds scary, when in reality, history has shown its just a blip on the radar long term;

I’m not discounting the fear, the fear is real and I’m here to say you are allowed to feel that, but do NOT let the media sway you, do not let friends talk you into changing ANYTHING! Do not talk to your neighbour and take their tips and make a move you will later regret. Do not move! Avoid emotional knee jerk reactions and filter out the noise to avoid mistakes. (See my earlier post around emotional investing)

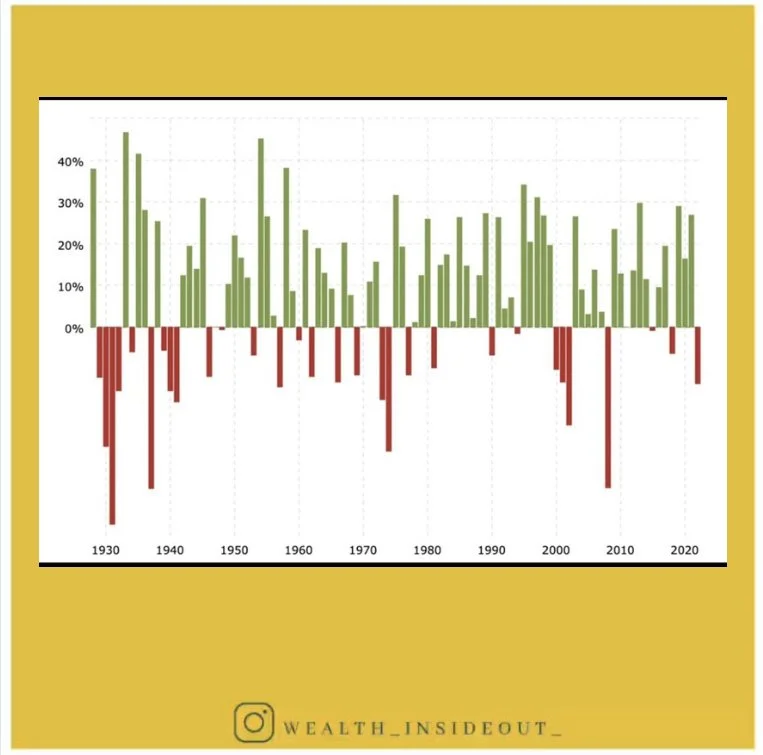

Market corrections are a normal part of investing. Since 1928, we've had 26 bear markets (decline) in the S&P 500, and 27 bull markets (incline). Gains during bull markets far outweigh the losses of bear markets.

Remember, we are playing the long game, (your money SHOULD NOT be in the market if it’s short term - it’s too risky!) and when investing for the long term this now provides you an opportunity to buy more shares at cheaper price to realize gains later.

Statistically, stocks lose an average of 36% in a bear market and gain an average of 114% in a bull market.

I read a great analogy today;

“When the shoes you love go on sale, we probably buy another pair in a different colour! We don’t try and sell our loved shoes at a discount”

Or how about this one;

“when you were dating in high school, and your partner broke up with you, At the time it’s devastating. 10 years later it’s pretty insignificant overall”

Bear markets can be an opportunity instead of panic! An opportunity to buy at a cheaper price.

If you are anxious and unsure this is the time having an advisor will pay dividends, reach out to them, or they should be reaching out to you to check in and smooth concerns. I went through the crash in 2008 with my clients, some unfortunately fear got the best of them, no matter what I had to say and they chose to cash in never recouping the loss, while the majority has a distant memory stayed invested for the long haul and reaped the rewards especially in 2013!

Albeit it was a bumpy, emotional and tremulous time for all involved - as an advisor we have our finger on the pulse, let us do what we do best.

You can refer to this graph for the bull (green) and bear (red) markets to show the history of the market and after a bear, always follows with a bull market to capitalize on.

Avoid Emotional Investing

People naturally tend to become emotionally invested in their own portfolios. They become overly greedy when markets are up and overly fearful when markets are down. The reasons for these attitudes are well documented by behavioural economics.

Having an Advisor keeps your emotions away from the investment process, amid all the volatility and unpredictability that markets show, the ultimate value of a planner is to keep you focused and in your seat. Focused more on your long term goals than the short term volatility of your portfolio. A really great article I read said, "A good Advisor will protect you, from you. No, your advisor can't stop you from feeling whatever emotions you're feeling, just like a guardrail can't stop every car from going into the ditch. In those moments where you want to push the eject button because you're scared, the advisor's job is to remind you of the plan you created and what you're working towards: "a fulfilling and successful retirement."

Good advisors help you navigate your emotions and coach you through choppy storms.

Isn't it also nice to have a partner for your journey to financial wholeness? Having someone in your corner who's as invested in your success as you are? I'm talking about an advisor who thoroughly knows you, your spouse, your kids, your dream job, your hopes and aspirations for your future. Someone who cares about you, knowing that your advisor truly has your best interest at heart is psychologically impactful. Just as people hire personal trainers or business coach's the advisor sets your up for success and roots for you every step along the way. If you don't have a connection with your advisor, I'd suggest you keep looking until you find one because they will make a world of difference.

Behavioural Study and Loss Aversion in Investing

It’s been a bumpy ride, I won’t deny that. Markets are volatile, the world is volatile.

Stay in your seat!

At this point in time I’d like to turn your attention to behavioural biases you may be consuming, and the instinctive human nature to loss aversion.

Are the messages you receive all doom and gloom? Are they from credible sources? How much attention are you giving to the negative and catastrophizing? Are you now only focused on short term vs. long term planning?

Again, this is not the time to do anything except lean on your advisor, or credible sources who understand how the market moves. Please see my blog post “Emotional Investing”

I met with a woman yesterday who wanted a second opinion on her portfolio because she “lost” quite a bit of money. Scrambling, experiencing many REAL and EXPECTED reactions to her financial statements, she wanted to pull all of it out to “stop the bleeding.”

Here’s also where loss aversion comes into play. Loss aversion in behavioral economics refers to a phenomenon where a real or potential loss is perceived by individuals as psychologically or emotionally more severe than an equivalent gain. For instance, the pain of losing $100 is often far greater than the joy gained in finding the same amount.

Sociologists point to the fact that we are socially conditioned to fear losing, in everything from monetary losses but also in competitive activities like sports and games to being rejected by a date. Or, fear that keeps you stuck in the same spot, I learned a lot about this in my Psychology and Neuroplasticity courses and its fascinating!

Investors can avoid psychological traps by adopting a strategic asset allocation strategy with their advisor, think rationally, and not let emotion get the better of them.

I want to remind you, that you do not lose until you cash it in! And, moving to a lower risk investment may slow the decline, but remember you will miss the incline! And, the incline WILL come. If you make a move now, you’ve lost. If you lower your risk it may look better in the short term, but not in the long term if we could extrapolate out.

Below is a graph of the bull (green) and bear (red) markets. Being an advisor in 2008 was treacherous, it WAS NOT a fun time. People did pull out at the bottom, against professional advice, please note the growth that proceeded the downturn.

Keep you bum in the seat!